Agreement vs. Court Child Support

Child support is a crucial element in ensuring the well-being and future of children whose parents are no longer together. While it is possible to go to […]

Do you lose your visitation if you fail to pick up the child on time?

A Universal Family Law Problem Parents sometimes come to me stressed because the other parent would not allow the child to go with them for visitation because […]

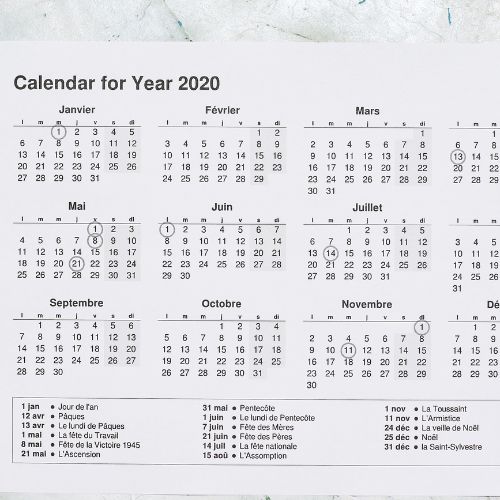

Introducing the 2020 Texas Standard Possession Order calendar

https://youtu.be/MKkHRJxqZrM https://yourchildsupportlawyer.com/visitation/

Can You Change Your Last Name to One Different From Your Maiden Name in a Texas Divorce

Under the Texas Family Code, a spouse may change her name back to a “name previously used by the party.” Sec. 6.706. CHANGE OF NAME. (a) In […]

2019 Harris County Family Judges – District & Child Support Court

The Texas State Family District Courts of Harris County (as of this blog post date) are listed here by the Harris County District Clerk. Most of judges are […]

Standard Possession Order Holidays Chart Cheat Sheet by YourChildSupportLawyer

Announcing a helpful cheat sheet for parents, lawyers, and judges to use to quickly know when a parent is supposed to have their odd and even year […]

TRANSFER ON DEATH DEED IN TEXAS Intersection of Family & Probate Law

A video discussion between Family Law Attorney Mac Pierre-Louis and Estate Planning Attorney Glenda Clausell on “Transfer on Death Deeds” (TODDs) in Texas to convey real property. […]

MANUALLY CALCULATING CHILD SUPPORT IN TEXAS CORRECTLY TO THE PENNY!

It can be challenging to calculate child support correctly. Plenty of apps and software I have reviewed do not give correct answers. These apps and software sometimes […]

TOP 5 CSRP (CHILD SUPPORT REVIEW PROCESS) TIPS TEXAS FAMILY LAW

Video Highlights You can see the relevant law from the Texas family code chapter 233 regarding CSRPs down below: http://www.statutes.legis.state.tx.us/Docs/FA/htm/FA.233.htm I have some tips to help […]

Spring Break Vacation in the Texas Standard Possession Order

ODD AND EVEN YEAR SPRING BREAKS The Standard Possession Order (SPO) states that on even numbered years the non-custodial parent possesses the child from 6pm on the […]

YouTube Educational Videos Now on YourChildSupportLawyer.com

Now available on YouTube is the YourChildSupportLawyer Video Channel, featuring educational and informational video blogs or “vlogs” to help parents navigate the issues of divorce, custody, and […]

Top 5 Reasons Family Law Orders Involving Children Are Modified in Texas

The following Top 5 reasons are rated in terms of weight and (in my opinion) importance not frequency: 5: Increase child support It’s usually the case […]

Can Stepparent Spouse Be Held Liable for Other Spouse’s Child Support Obligation?

The simple answer is no, generally a stepparent will not be held liable for their spouse’s child support nonpayments. In fact in Texas the person held liable […]

Recent Honor for Yourchildsupportlawyer.com from Texas Bar Today!

Top 10 blog posts from the past week on @texasbartoday: Hot coffee, jeans & #SCOTUS https://t.co/WYo3TKlse0 pic.twitter.com/dJhlz5a7Dr — State Bar of Texas (@statebaroftexas) October 7, 2016

No, You Can’t Wear Jeans to Court! Dress Code and Attire Rules to Win Your Case

Let’s chat a bit about courtroom attire. This topic comes up due to the high number of folks I’ve seen walk into court dressed inappropriately. Judges and […]

Back to School Tips 2016

Back to School Tips 2016-From Former Teacher Turned Lawyer Mac Pierre-Louis Make a Plan Going back to school can be very traumatic for some kids. It’s very […]

Upcoming Event: Family Law Seminar Houston

In Houston this summer? Join us for our free upcoming Family Law seminar on you and your money!

Top 4 Reasons to Exercise Your Extended Summer Possession Order Rights

Summer is here! Time for vacations, outdoors, and fun. Most kids are out of school and most parents are able to take time off from work. If […]

Are you Sure You Have a Common Law Marriage? Texas Common Law Marriage Requirements

Some Texas couples live together for years but never get a marriage license. They believe that because they share the same home, have children together, and mix […]

SUPPORT FOR A MINOR OR ADULT CHILD WITH DISABILITY IN TEXAS (TFC 154.301+)

Child Support for a Minor Child With Disability in Texas Texas courts may order either or both parents to provide support for a child for an “indefinite […]

Define Father

Tolstoy once said, “All happy families are alike; each unhappy family is unhappy in its own way.” Tolstoy was wrong, at least he’s wrong in the twenty-first […]

SHOULD YOU BRING A LAWYER TO TX AG CSRPs (CHILD SUPPORT REVIEW) MEETINGS?

Everyday, Texas parents who have Attorney General (AG) child support cases receive Child Support Review Process Notices inviting them to attend negotiation conferences in child support field offices across the […]

WHEN AN NCP PAID AHEAD IN CHILD SUPPORT?

Paid Ahead It’s a common practice to confirm in a court order that an NCP is behind in child support arrears. For example: “Dad owes mom $1000 in […]

Do I need my Ex’s consent to travel out of the country with our child?

If you have a court order specifically requiring you to obtain consent, you must do so. If no such court order exists, and if no travel restrictions […]

The age a child can decide which parent to live with under Texas law

Can a child choose which parent she wants to live with? It depends. Texas law sets 12 years old as the age a child can be interviewed […]

Claiming a child as a tax dependent who does not live with you

It’s Spring! That time of year when parents nationwide claim their dependent minor children on their federal taxes. Child Tax Credit The Child Tax Credit is a […]

UCCJEA: Changing Custody from Texas

If you live in Texas with a valid TX custody order, but then let your child go out of state to live with the other parent, can […]

Failing to pay child support can keep you from becoming a US Citizen

Your application to become a US citizen may be denied for failure to pay child support. Why? Good Moral Character To become a citizen, you must exhibit “Good […]

Ten Things You Didn’t Know About Child Support

Child support is money paid to provide some or all basic needs of a child such as food, clothing and child care, there are many other aspects […]

Canceling Health Insurance Plan for a Child Under a Court Order

WHEN YOU WANT YOUR EMPLOYER TO STOP PROVIDING MEDICAL INSURANCE FOR YOUR CHILD There are some instances where a custodial or noncustodial parent wants their boss or human […]

Texas and the Interstate Family Support Act Amendments (2008)

State of Texas legislators have approved House Bill 3538, which incorporates federal laws involving international child support into state law. The bill has been sent to the […]

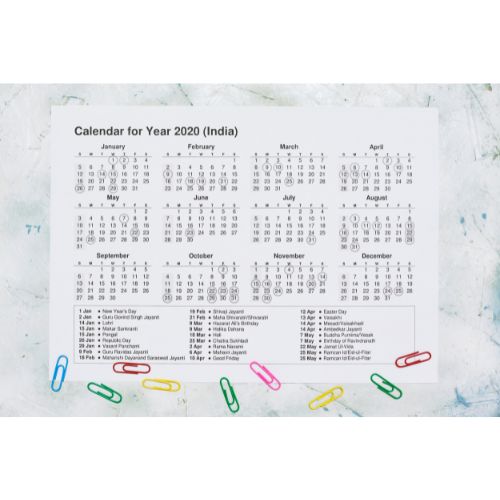

Indian Courts to fix child support till age of 25 – The Times of India

For the first time in India, the concept of shared parenting has been proposed to give joint custody rights of a child to both parents in case […]

WHAT’S NEW IN TEXAS CALCULATOR VERSION 3.0–Calculate Withholding

Now when you calculate child support using the TX Calculator App, you will see green “Calculate Wage Withholding” icons that help calculate withholding amounts due from the […]

TX Child Support Today Calculator App Tip: Using the Union Dues Window for More than Union dues.

The Union Dues window of the TX Child Support Today Calculator App (currently version 2.0) does not get very much love. There are not very many union […]

Child Support Payment reductions, Proposed Changes, and Modernizations

Nebraska has proposed legislation to lower child support for non-custodial parents. The logic behind Nebraska proposing a reduction in support—that cost of living has lowered and support […]

Over 116 Billion Arrears Owed Nationally

Owed child support and not getting paid? According to the Rocky Mountain PBS News, you’re not alone. In the state of Colorado, a third of the state’s […]

Even Stars Pay Child Support

Celebrity magazines often try to compare how stars are similar to every day Joes. These articles usually concern mundane things such as the sort of beverage at […]

Child Support Scams

In San Antonio, a woman was recently was robbed. What was taken? Her child support. The case in unfortunately not that unusual criminals used Child Support to […]

Paychecks and Child Support Calculation

Child support is calculated in Texas on a precise formula. The formula can seem convoluted to someone who is not familiar with how it works. A single […]

The Dog Ate My Child Support Check

While most people wouldn’t tell a judge that their dog ate their missing child support payments, there are actually some pretty flabbergasting and sometimes hilarious excuses that […]

Can Collaborative Law be Used for Child Support Issues?

Collaborative Law The concept of collaborative law sounds almost oxymoronic. When one thinks of collaborating, they think of exchanging ideas in a flexible environment. The law is […]

A BRIEF EXPLANATION OF SEVERAL ENTRY WINDOWS OF THE TEXAS CHILDSUPPORTTODAY.COM CALCULATOR APP (version 1.04)

Brief Explanation of Entry Windows (App version 1.04 & 2.0) 1. Employed Gross– Enter the obligor’s monthly gross earnings from work income. Such as income from W-2 […]

DISCOVERING THE CHILD IS NOT YOURS

The issue of a parent supporting a minor child they believed was theirs is an international issue. This one in Australia.

INTRODUCING THE CST IPHONE SUPPORT CALCULATOR APP

Pleased to announce the roll out of the Texas edition of the Childsupporttoday.com support calculator app. More information to come in the upcoming days. A calculator help […]

WHY CAN’T YOU JUST FILE BANKRUPTCY TO END YOUR CHILD SUPPORT DEBT?

Many non-custodial parents (NCPs) have been tempted to wipe away their child support debt through bankruptcy, but they soon realize bankruptcy law does not treat all debts […]

Q&A: HOW IT WORKS IN TEXAS WHEN YOU RECEIVE CHILD SUPPORT FROM ONE PARENT BUT ALSO PAY CHILD SUPPORT TO ANOTHER

Imagine that mom Jane Doe receives $1000 each month in child support from dad John Doe for their daughter. Also imagine that Jane Doe has to now […]

SHOULD A FAMILY COURT JUDGE EVER OWE BACK CHILD SUPPORT?

Not to get on the judiciary here, but this post involves an important ethical question. When is it okay for a family court judge to owe back child […]

SHE SAID IT WAS A GIFT. HE SAYS IT WAS FOR CHILD SUPPORT!

John and Jane Doe, imaginary separated parents, are sitting in a child support office with a caseworker negotiating a new child support order. They make it through […]

WOULD YOU POST THE OTHER PARENT’S NON CHILD SUPPORT ON SOCIAL MEDIA TO SHAME THEM?

This topic originally appeared in the CNN article, ‘Dead Beat Kenya’ Facebook page claims to expose absentee parents by Faith Karimi. The article is worth the read as it […]

THE INTERSECTION OF FAMILY VIOLENCE AND CHILD SUPPORT LAW

By now, everyone has heard and opined on the domestic violence controversy involving Ray Rice and his wife, Janay Palmer. If you’re unfamiliar with this story stemming […]

Q&A: HOW TO REMOVE A CHILD SUPPORT LIEN OFF YOUR HOME IN TEXAS

Child support liens are typically placed by a child support office or other judgement creditor on an NCP’s real estate property such as a house when that […]

SO YOU’VE BEEN PAYING SUPPORT DESPITE HAVING THE CHILD? WHY?!?

Perhaps it’s not knowing the law but I’ve ran into the trend (albeit small) where the NCP continues paying the CP support while having physical custody of […]

WHEN YOUR TEXAS DRIVERS LICENSE GETS SUSPENDED

Texas Child Support Drivers License Suspension Texas’ license suspension rules are pretty straightforward: Under TFC 232.003, if you are behind in child support for 3 or more […]

Q&A: DOES A CHILD SUPPORT OFFICE LOOK INTO IMMIGRATION STATUS?

This one is controversial. With all the legal and lay opinions on “anchor babies” and immigration reform, there is bound to be some heartfelt feelings on social […]

MICHIGAN: A DEFENSE TO NOT PAYING SUPPORT?: I’M UNABLE TO BAY versus IT’S IMPOSSIBLE TO PAY

Interesting news tidbit coming out of Michigan’s Supreme Court involving defenses to child support enforcement: NCPs now have a defense against child support enforcement–that they cannot pay […]

CHILD SUPPORT SWEEP NABS 44 IN GLOUCESTER COUNTY

CREDIT: WPVI-TV/DT Philadelphia: WOODBURY, N.J. – December 17, 2013 (WPVI) — 44 people were arrested during an early morning child support sweep in Gloucester County. The total cash […]

FLEEING YOUR HOME STATE DOES NOT NECESSARILY END ITS JURISDICTION OVER YOU WHEN SETTING CHILD SUPPORT

Most people know that in the United States when a person flees their home state for another state to escape prosecution for a crime, the other state […]

Q&A: CAN CP PRIVATELY SUSPEND NCP’S LICENSE FOR NOT PAYING CHILD SUPPORT?

#10162209 / gettyimages.com Probably! Although it’s rare, Texas Family Code Chapter 232.004a does allow a private individual such as a CP to file papers with the court […]

DRIVERS LICENSES ARE NOT THE ONLY LICENSES THAT CAN BE SUSPENDED FOR FAILURE TO PAY CHILD SUPPORT

Texas Family Code Chapter 232 allows the NCP’s licenses to be suspended for failure to pay child support. Most people think of drivers licenses when they think […]

TEXAS LAW–CHILD SUPPORT CAP TO RISE

Quoted from myFoxdfw.com:DALLAS –There are new guidelines for calculating maximum child support payments. Beginning Sept. 1 the new guideline for one child is 20 percent of $8,550, which […]

FATHER SAYS HE’S STILL PAYING CHILD SUPPORT FOR 3-YEAR-OLD SON WHO DIED 25 YEARS AGO

Found this story rather interesting. Includes a CP who conveniently remains quiet and an NCP who’s out to bring attention to his injustice:Father says he’s still paying child support […]

CAN’T RENEW YOUR PASSPORT? THIS MIGHT BE A REASON WHY…

Federal law (42 USC 652(k) & 654(31)) allows the Department of Health & Human Services (DHS) to talk with states’ child support offices to confirm whether an NCP […]

WHAT HAPPENS WHEN YOU’RE AWAY ON MILITARY ACTIVE DUTY AND GET SERVED WITH CHILD SUPPORT COURT PAPERS?

Many people serve in the US military. Sometimes they go on active duty. How should an NCP on active duty respond when he is served with court papers […]

THREE SCENARIOS WHEN A CHILD SUPPORT ORDER BEGINS ADDRESSING A CHILD’S DISABILITY

States, including Texas, maintain laws on support of minor or adult children with disabilities. Here are three common scenarios when child support orders begin addressing support for children’s […]

DAYTIME TV JUDGE GOES OFF ON NCP!

I came across this YouTube video the other day involving a small claims court dispute between an ex-girlfriend and her future NCP. It unexpectedly turns to child […]

ESTABLISHING PATERNITY AGAINST A DECEASED NCP

Suppose a mom (CP) visits her local state child support office and alleges that a certain man (NCP) is her child’s father. Then suppose that midway through […]

WHAT IS “TITLE IV-D COURTS ANYWAY?

People commonly hear of “IV-D” or “4D” or “Title IV-D Courts” when child support issues are being discussed. But what exactly is IV-D? Where does the reference […]

HOW CHILD SUPPORT ORDERS PROTECT THE RIGHTS OF THE NON-CUSTODIAL PARENT (NCP)

A typical scenario that proves child support orders protect non-custodial (NCPs) is when the NCP insists on foregoing a child support order in order to provide direct […]